FKLI Jan 06 Oops! Trade 1 – Closed with a net loss RM225 (Jan 9 06 to Jan 12 06)

Trade Planning and Management

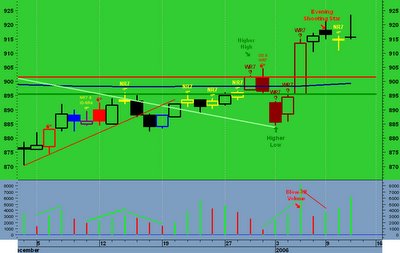

FKLI Jan 06 Chart as Jan 06 06

January 9, 2006

1. Entry Strategy for Oops! Buy stop order

a. Option 1: If the price opens gaps down from prior day’s low, put a buy stop order 1 tick above prior-day low after FKLI opens.

b. Option 2: If the price opens flat or higher than prior day’s low, do nothing.

2. Entry Strategy for Oops! Sell stop order

a. Option 1: If the price opens gaps up from prior day’s low, put a buy stop order 1 tick below prior-day low after FKLI opens.

b. Option 2: If the price opens flat or lower than prior day’s low, do nothing.

3. Entry Strategy for Oops! Buy stop order during Rollover period (starting 22nd of the month):

a. Option 1: If the price of both Spot and Next month contract opens gapped down from prior day’s low, put a buy stop order 1 tick above prior-day low after FKLI opens.

b. Option 2: If either the price of Spot and Next month contract opens gapped down, do nothing.

c. Option 3: If the price opens flat or higher than prior day’s low, do nothing.

4. Entry Strategy for Oops! Sell stop order during Rollover period (starting 22nd of the month):

a. Option 1: If the price opens gaps up from prior day’s low, put a buy stop order 1 tick below prior-day low after FKLI opens.

b. Option 2: If either the price of Spot and Next month contract opens gapped up, do nothing.

c. Option 3: If the price opens flat or lower than prior day’s low, do nothing.

5. Adding More Contracts and Re-entry Strategy

a. No adding more contracts and Re-entry Strategy

6. Trade Management

a. If the stop order is triggered, put a stop order:

i. 1 tick below the intra-day’s low for Buy stop order.

ii. 1 tick above the intra-day’s high for Sell stop order.

b. Exit Strategy

i. MOC – if the price hits extreme in your favor. The extreme is when a long outside-day is formed with Close near Low or High. Close at 5:14pm.

ii. Next day‘s Open – if the trade is profitable but the price is not extreme, leave it over-night. Exit next day’s Open if the price gaps in your favor.

iii. Next day’s Close – if the price hits extreme in your favor. The extreme is when a long candle is formed with Close near Low or High. Close at 5:14pm

iv. 10 to 16-point profit. – Exit immediately

v. If there is no ascending or descending triangle target, use Fibonacci 161.8% as a possible target for trend-following Oops!.

c. Trailing Stop for Exit on Next day Close or subsequent days

i. The protective stop cannot increase your risk (loss) and reduce your profit unless No 6 and 7 below.

ii. The protective stop cannot give back more than 6 points of unrealized profit.

iii. When the trade is profitable, move your protective stop to the breakeven point. Trail your stop.

iv. When the trade is profitable, move your protective stop. Short Position: Move your stop to 1 tick above the open or high, whichever is lower, for sell stop but must be lower than your previous stop. Long Position: Move your stop to 1 tick below the open or low, whichever is higher, for buy stop but must be higher than your previous stop.

v. If the price moves in your favor, the trade is profitable and the prior day bar is a long bar (more than 8 points), move your stop 1 tick above or below the middle of the bar.

vi. Short Position: If prior-day’s bar is a long bar (8 points or more) and the today’s open is higher than prior day’s close but below the middle range of prior-day’s range, put your stop at 1 tick above the middle of prior-day’s range. Long Position: If prior-day’s bar is a long bar (8 points or more) and the today’s open is lower than prior day’s close but above the middle of prior-day’s range, put your stop 1 tick below the middle of prior day’s range.

vii. Short Position: If prior day bar is a long bar (8 points or more) and the today’s open is lower than prior day’s low, put your stop at 1 tick above the prior day’s low. Long Position: If prior day bar is a long bar (8 points or more) and the today’s open is higher than prior day’s high, put your stop 1 tick below the prior day’s high.

viii. Short Position: If prior-day’s bar is a long bar (8 points or more) and the today’s open is higher than both prior day’s close and middle range of prior-day’s range, put your stop at 1 tick above the prior-day’s high. Long Position: If prior-day’s bar is a long bar (8 points or more) and the today’s open is lower than both prior day’s close and middle of prior-day’s range, put your stop 1 tick below the prior day’s low.

ix. The maximum loss is 10 points or high/low of the next bar if the price gaps

7. Today’s Entry strategy:

a. Call Apex at 8:45am to check the opening price. Ask Apex for the following before entering a trade:

i. Open

ii. High and Low

iii. Last Done

iv. Prior day high / low (if not remembered or need confirmation)

b. If the price opens gaps up or down, put a stop order

c. Ask them to inform you when any trade is done. If the stop order is triggered, put a protective stop order based on intra-day High or Low.

d. Exit on MOC, next day‘s Open, next day’s Close or 10-point profit.

e. Let the trailing buy stop follow the price until it is taken out.

8. My actual Entry strategy

a. I called Apex to check the Open at 8:46am. The price opened gapped up at 918 with high of 921.5. I automatically put in my sell stop order at 916.5.

b. I was waiting for my sell stop to be triggered for the whole morning. But I did not receive any call. Look like to CI and FKLI are still strong.

c. My buy stop order was triggered at 913 at 12:15pm. I immediately inform Apex to put my buy stop order at 922, 1 tick above intra-day’s high of 921.5.

d. The price hit low of 915 after lunch and moved around the range of 916 and 917.5.

e. I told myself to close my position if there is a loss.

f. CI closed up 2.13 points. But it is forming an evening shooting star. I may stay on with my position if the price near MOC is lower than the open of 918.

g. The price closed at 916.5 with higher volume of 3742

9. Trade executed according to plan? Yes

January 11, 2006

1. Today’s Trade Management:

a. Call Apex at 8:45am to check the opening price.

b. Initial Trailing Stop:

i. If the price opens gaps down, close your position immediately. Remember, Oops! is most powerful this time. It is also price-extreme.

ii. If the price opens gapped down, do nothing initially. Close your position after 10:30am if the price stays gapped down.

iii. If the price opens higher, flat or lower, put your buy stop order at 922, 1tick above previous day’s high.

c. Possible Exits:

i. MOC

ii. There is a price extreme – a long white candle with close near the high or a long black candle with the close near the low with blow-off volume.

iii. If there is 10-point profit.

iv. Let the trailing buy or sell stop follow the price until it is taken out (if there is a down-trend)

v. Use Fibonacci 161.8% as a target if it is trend-following Oops!

d. Subsequent Trailing Stop:

i. The breakeven point, 915.5, after the price breaks 9810.5, 2nd previous day’s low.

ii. 913.5, 1 tick above the intra-day’s high, if the price breaks 905.

2. My actual trade management:

a. I called Apex at 8:45am to check the Open. The price opened lower and hit 914.5. I immediately put in my buy stop at 922.

b. I did not monitor much. The price hit 911 low after CI opened before moving up to hit high of 916 at 12pm.

c. The price then moved down again as CI is dropping. It hit 912 again.

d. The price then moved up to 915 before closing at 914.5.

e. The trend is up. Shorting is not favorable. I will stay on the trade

3. Trade executed according to plan? Yes

January 12, 2006

1. Today’s Trade Management:

a. Call Apex at 8:45am to check the opening price.

b. Initial Trailing Stop:

i. If the price opens gaps down, close your position immediately. Remember, Oops! is most powerful this time. It is also price-extreme.

ii. If the price opens gapped up, do nothing initially. Close your position after 10:30am if the price stays gapped up.

iii. If the price opens higher, flat or lower, put your buy stop order at 922, 1 tick above the recent high as it is a trend following Oops! Sell.

c. Possible Exits:

i. MOC

ii. There is a price extreme – a long white candle with close near the high or a long black candle with the close near the low with blow-off volume.

iii. If there is 10-point profit.

iv. Let the trailing buy or sell stop follow the price until it is taken out (if there is a down-trend)

v. Use Fibonacci 161.8% as a target if it is trend-following Oops!

d. Subsequent Trailing Stop:

i. The breakeven point, 915.5, after the price breaks 910.5, 3rd previous day’s low.

ii. 913.5, 1 tick above the intra-day’s high, if the price breaks 905.

2. My actual trade management:

a. I called Apex at 8:45am to check the Open. The price opened lower and hit 914.5. I immediately put in my buy stop at 922.

b. I did not monitor much. The price hit 918.5 and moved down after 9:30am.

c. I told myself to cover if the price moves up 919.

d. The price moved up after 10:15am to 919.5. I was not able to cover at 919.

e. I only able to cover at 920. The price then moved up to hit 923.5 before closing at 915.5 with low of 914.5.

f. It is a whipsaw day. I was able to get out if I am wrong.

g. I lost RM225 (RM175 + RM50 commission).

3. Trade executed according to plan? Yes

4. What I have done best:

a. I follow Oops! entry.

b. I let the order for the whole day before MOC.

5. What I need to improve:

a. I need improve my exit rule so that I can stay consistent.

b. I need to back-test Oops! with trend following.

c. I need to trade less and concentrate on high risk-reward ratio trade of more than 3 and small losses

6. What I have learned:

a. If you are wrong, get out immediately. Do not hope.

3 Comments:

Do you trade all Oops! signal?

Gaps happen very frequently in Futures.

Do you trade all Oops! signal?

It seems to me that gaps happen very frenquent in Futures.

I may take all Oops! signal.

If the trend is up based tren-line analysis. I will take Oops! Buy Signal and I will not Oops! Sell signal. The trend is your friend.

Post a Comment

<< Home